October brings financial challenges, and interest rates are (as always) in the spotlight. Will it grow? Is a fixed interest rate a smart choice? Ivica Žuro uses experiences from the past, but also some guidelines for the future, to help us in our decision. And with the right tips, who knows - you might even make a profit.

October is still a very active month, but we need to think about what to do next.

Whether it was the acquisition of basic assets whether it was the provision of working capital for smooth, normal operations, good preparation saves time. And getting nervous before reduces the amount of stress afterwards.

As always, we will first put pen and paper in our hands, or keyboard and Excel and related solutions in front of us on the table.

So, let's deal with the most frequently asked questions:

- What can be expected from interests?

- Will it continue to grow?

- Is it wise to go for a fixed interest rate agreement?

What can be expected from interest?

No one has a crystal ball, but we have experiences from the near and far past that we will try to interpret to make the decision easier.

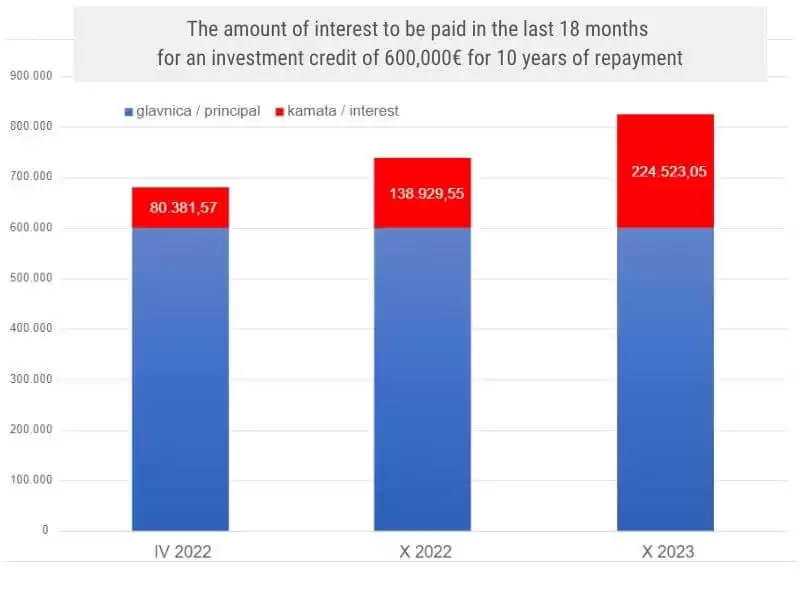

Interest is the focus of everyone's attention and the only noticeable thing - it has grown significantly, burdening the rest of the business with those loans contracted with a variable rate.

Will interest rates continue to rise?

Some geopolitics, some politics, and in a year and a half, the main reference interest rates to which all banks in the Eurozone are tied when defining the cost of financing jumped from -0.5% to 4%.

The very often used 3m EURIBOR (three-month) has a current value - as it is colloquially said - below 4.0%, and if the creditor's margin on that is 3%, then the total interest rate at that moment is almost 7.0%.

In the last 15 years - that is since the great financial crisis of 2008, caused by the greed of the investment part of the financial sector - the only time when reference rates were close to these was exactly 15 years ago.

And in the last 23 years, another moment happened that also brought these same interest rates to the level of 5% - the collapse of the DotCom market, i.e. the huge drop in the value of technology companies in the second part of 2000.

We don't want to be prophets of doom. Still, we always point out - think carefully and consult with the profession in everything you do, and especially in this one.

We will list guidelines that should be followed when considering investments in various goods through lending for natural persons. The same principles are fully applicable to the financing of legal entities.

Is it wise to go for a fixed interest rate agreement?

If you go for any loan with a fixed interest rate - insist on as little as possible or no fee at all for early closing. Due to the reduced credit production of banks, it is possible that you will achieve something. 😉

Furthermore, as much as it generally makes sense to take out a loan with an interest rate lower than the prevailing inflation rate, if there is no immediate need, don't go for the purchase of consumer goods through a cash loan right now.

Figuratively speaking - it's not like you need to slap yourself with joy if you were lucky enough to get a loan with an interest rate of 8% at the time of inflation of 13.1%.

Currently, any nominal interest rate at the level of 3.50% is acceptable for housing loans.

And then? How to proceed, and what is the "math"?

You will do the right thing if you find a bank that does not charge a fee for loan approval, with, of course, a reduction in the early closing fee during the period of application of the fixed interest rate.

It is easily possible that in the long term, whoever takes out a loan in the second quarter of next year and beyond could profit.

Why?

Given that the European Central Bank follows the US FED with a delay of half a year to 9 months - and in the US, it has been announced that there will be no further increase in key interest rates, the math here is very simple.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox