Financial stability and growth are essential for the long-term success of any company. But how do you ensure that your business decisions yield positive results? In this article, Ivica Žuro reveals the most important rules and principles to help you manage your business finances effectively and avoid common pitfalls.

General rules for business operations apply to every profession, which is also true for business finance.

Recognized by business practice, these rules are expressed as very useful advice that guarantees survival and creates a foundation for the development of entrepreneurial ventures.

Besides the classic rule which states that it is wise to categorize business operations whenever possible because the cash flow should not encounter problems, it is necessary to be aware of several facts to effectively manage both business and personal finances.

First, there is a correlation between the value of money and time, so financing the same amount through short-term loans is more favourable even when the interest rate is higher.

This is well illustrated by the example of borrowing an amount of 100,000 euros, where repayment is one year shorter, and with a 1% higher interest rate, it is ultimately cheaper by 1,055 euros:

- if the loan is repaid over 4 years with a 7% interest rate, the interest amount to be repaid is 14,942 euros

- if the loan is repaid over 5 years with a 6% interest rate, the interest amount to be repaid is 15,997 euros

Aligning liabilities and assets

The total cost of money should be covered by income from business activities, and loans should only be taken if the potential earnings exceed the cost you will pay.

You should never create liabilities greater than the available assets.

Attention should be paid to the structure of assets and liabilities, i.e., short-term liabilities should be covered by short-term sources, and long-term liabilities by long-term sources of financing.

No one prevents you from trying to do the opposite, i.e., unreasonably burdening the balance sheet.

Fortunately, bank loans have a clear purpose that must be implemented in practice. A small part of the total long-term loan may be used as working capital, and that's it.

Interest and other yields should be calculated wherever possible. Meanwhile, actively use the financial leverage rule, which states: receivables should be collected as soon as possible, and liabilities should be stretched out as long as possible.

Horizontal and vertical financing rules

Considering all this, effective financial management involves knowing how to use horizontal and vertical rules in practice.

Horizontal rules

The golden banking rule applied to companies states: Companies should use their short-term sources of funds to finance working capital and long-term sources of funds to finance fixed assets.

The golden balance rule emphasizes that long-term tied assets and all long-term investments are financed from long-term (owned and borrowed) sources of funds. Similarly, short-term investments are financed in such a way that only permanent working capital can be financed on a medium-term basis, up to 3 years, and all other short-term investments exclusively for up to 12 months.

Vertical financing rules

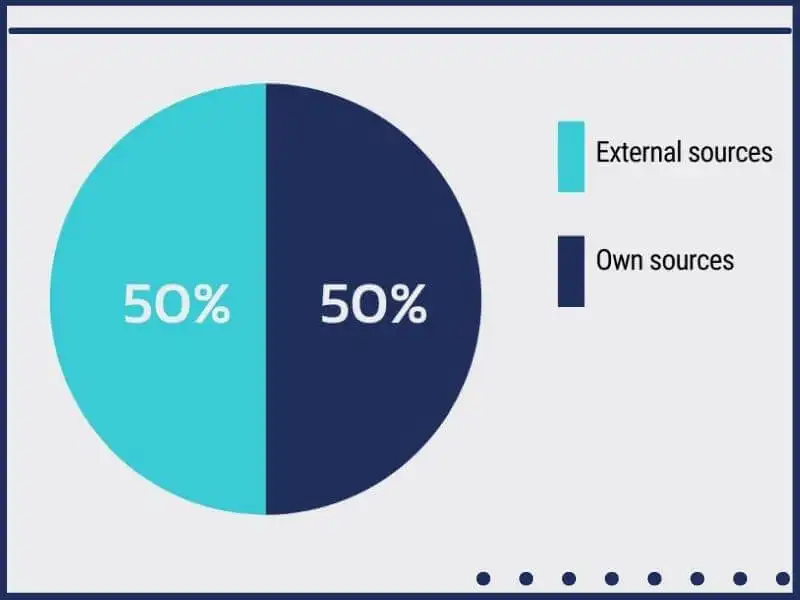

The 1:1 rule refers to the structure of capital sources where the share of external sources, except in the case of certain investments with high potential, should not exceed half.

As long as its own sources prevail, the company can have very high financial stability and be adaptable to all market disturbances.

Even if there is a loss due to an extraordinary situation – a clear example of this was the 2020 pandemic – such a structure will allow for recovery in due course.

As long as the amount of accumulated losses is less than the company's share capital, the company will have low and acceptable financing costs from borrowed capital.

The 2:1 financing rule states that liquid or quickly marketable assets should have twice the value of short-term sources of financing.

The ratio of equity to reserves suggests that the more secure and stable a company's operations are, the greater the reserves that are formed over a longer period of time from the company's profits. This says a lot about the quality of management, as their existence provides creditors with the security that their claims will be paid. Naturally, banks also favour companies where capital accumulates and profits are retained, as this is the best sign that the owners and management are committed to the business's long-term survival.

Principles of business financing

These were the rules to adhere to, and in combination with sound business reasoning – and common sense in general – the principles of business financing have been filtered from them.

Here, we will list the most important ones:

- Principle of security - only investments that will return the money or have the least risk are financed.

- Principle of liquidity - short-term assets should be converted into cash as quickly as possible and at the lowest cost.

- Principle of solvency - available funds must be greater than the due liabilities on a given day.

- Principle of stability - companies should primarily ensure the financing of regular operations from their own sources, using external sources for development and investments.

- Principle of profitability - money should be invested in ventures where it will generate the highest return.

- Principle of independence in financing - the higher the proportion of own funds in financing, the more independent the company is from all market factors, increasing the freedom of decision-making.

Finally, we emphasize what is the foundation of the entire story when it comes to external sources of financing – timeliness and accuracy of reporting.

You can have the best possible plan or study proving the viability of the investment for which you seek a loan, along with interested buyers.

Regardless of this, as well as the company's size and potential collateral, you are eligible for company financing only if you demonstrate the quality of business reporting and provide all relevant information concerning the company's operations.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox