While everyone else ran for safety, he went the other way - straight into the crisis. In the middle of the tourism collapse during the pandemic, Ivica Žuro decided to start a consulting firm. Not out of madness, but out of conviction that the most important moves are made when times are toughest. In this piece for čarter.hr, he takes us through real negotiations with banks, concrete business decisions, and plans with a clear goal: survival is the first step - what comes next is putting things in order.

People usually remember the past like in the song by Gabi Novak, who remembers only happy days - that is, through the lens of pleasant memories when they were younger, in better shape, with high fighting morale and all sorts of other things. And somehow, you were always in a good mood.

This column will have a nostalgic tone, but not for the same reasons as most people. It's because money is accumulated and a company is organized when times are best. You never know what might happen, and the situation might pull the rug out from under you - so it's better to pay attention in time.

Crisis? The perfect time to start!

The return to the past goes back to not-so-distant 2021, when I embarked on an independent entrepreneurial venture, as no longer a young financial consultant.

There was an extraordinary situation related to the pandemic, which had significantly damaged domestic tourism, and in anticipation of a better summer with more relaxed measures, all companies connected to that sector were anxiously watching what the near future would bring.

The vast majority managed to obtain some kind of loan to bridge their obligations or for working capital. Those who were in the middle of investments received moratoriums on repayments, but that can't last forever. Sooner or later, the obligation to repay will return in full.

Since I wanted to work in consulting related to management, finance, and businesses, the question was what to do. And the answer presented itself: help them build a foundation to survive a little longer without income, and demonstrate responsibility and seriousness. If they manage to maintain their credit rating - great. One day there will be investments, and maybe someone will call you if you help them survive now.

So, the idea was to help companies facing problems caused by external storms and misfortune.

How was that achieved?

Buzzwords work, but only when you know what you’re talking about

The basics of management - namely cost control, better organization, and communication.

It’s a general concept and a buzzword that covers a lot, but in practice it comes down to addressing the root causes along with treating the symptoms of the illness, which are reflected in the balance sheet and the profit and loss statement.

Among other things, we contacted creditors as well as debtors and explained the situation, and prior to that - based on, without false modesty, extensive experience in approving hundreds of loans per year - we developed proposals on how existing obligations could be refinanced.

It also helped that, thanks to my established professional banking credibility among colleagues in the financial sector, I understood what they were dealing with as well. So the proposals aimed to help both sides and provide a framework for action.

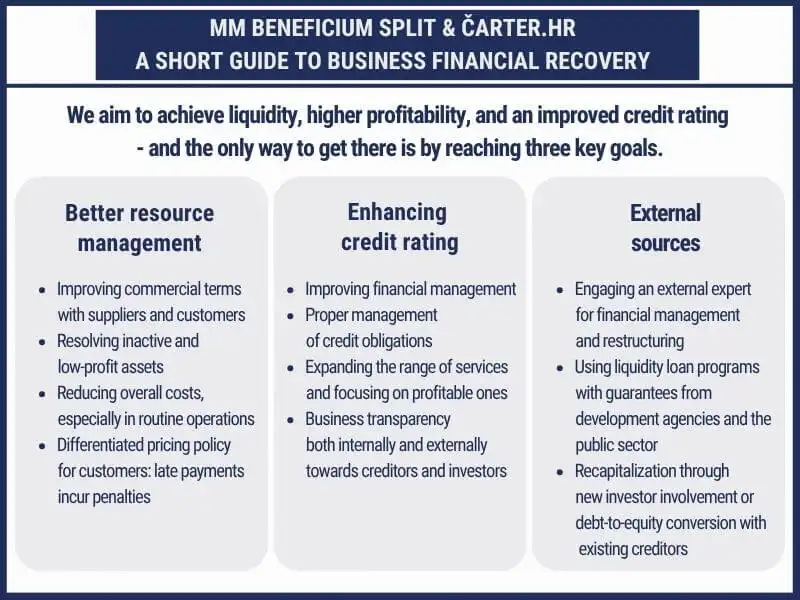

A positive response, of course, would not have come without a demonstrated management plan and a structured business model intended to improve the liquidity and credit rating of the indebted companies.

Such a plan included a combination of financial, operational, and strategic measures, each of which involved 5 additional steps we could take.

What mattered was that we tried to implement these measures and their sub-measures as systematically and in as coordinated a way as possible, in order to:

- enable indebted companies to stabilize their cash flow

- reduce the risk of illiquidity

- and improve their creditworthiness and market position.

Without money, there’s no music (literally)

Finances are crucial here not because I personally work with them, but because without money there is no music - or anything else, for that matter.

Accurate financial record-keeping, regular - not just formal - audits, and transparent reporting of income and expenses increase the trust of banks and business partners.

And no matter how well you know operations, sales, finance, or whatever else, only one thing holds true:

Successful and profitable organizations are such because they were willing to work on themselves and listen to those who could help them.

You focus on work, let someone else negotiate for you

Engaging a financial management and restructuring expert can significantly help in developing and implementing strategies to improve credit rating and liquidity.

In addition to professional support, it frees up the entrepreneur and their team from having to handle this part of the work, allowing them to focus on the core business and on how to maximize earnings.

There are people who will deal with banks, suppliers, and everything that involves costs - you just work and earn, and together we’ll achieve the same (or even better) jump in profit than the one in revenue.

Achieving a stable cash flow and increased profitability while revenues are growing is a very demanding and serious task.

But once the mentioned goals related to credit rating and liquidity are met, and a framework for continuously successful business is created, the risks in business generally become significantly lower - because management discipline reflects on the organization as a whole.

So not only will profitability improve, but organization usually will as well.

And everyone wants serious and well-organized people as business partners.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

- Graphic design

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox