- 05.12.2023.

- News, Regulations

Do you know what ESG means and how it relates to modern business? ESG is not just another in a series of modern acronyms; it is a crucial concept that transforms business. Ivica Žuro writes about how ESG affects financing, sustainability, and even nautical charter and how your company can adapt to these changes before it's too late.

Although reminiscent of ROFL, BFG, LOL and similar modern words, ESG, as one of the most mentioned terms in recent times, is quite far from these abbreviations.

Practically, there is not a day that the public is not sent a call to action by the implementers of this business principle aimed at sustainability in business, even though the deadline for implementation is quite far.

Commercial banks organize meetings for their clients where they discuss this matter, and if you receive a similar invitation, even though you are not obliged to report ESG - go.

If nothing, you will get PR and expand your network of contacts.

Nautical charter and ESG - to sail or not to sail?

All joking aside, a nautical charter is not immune to the business changes that will occur, and the good thing is that the vast majority of entities on the domestic market have enough time to prepare.

For the average yacht charter company, this is a distant future because companies that are not listed on the stock exchanges should become obligated to submit ESG information along with business reports only from 2027.

However, the old Latins used to say Sero venientibus ossa during the rebuking of carefree youth, i.e. Those who are late are left with only bones to eat, so let's see on time what it's all about. It may be a liability, but it is also a business opportunity, as you will see.

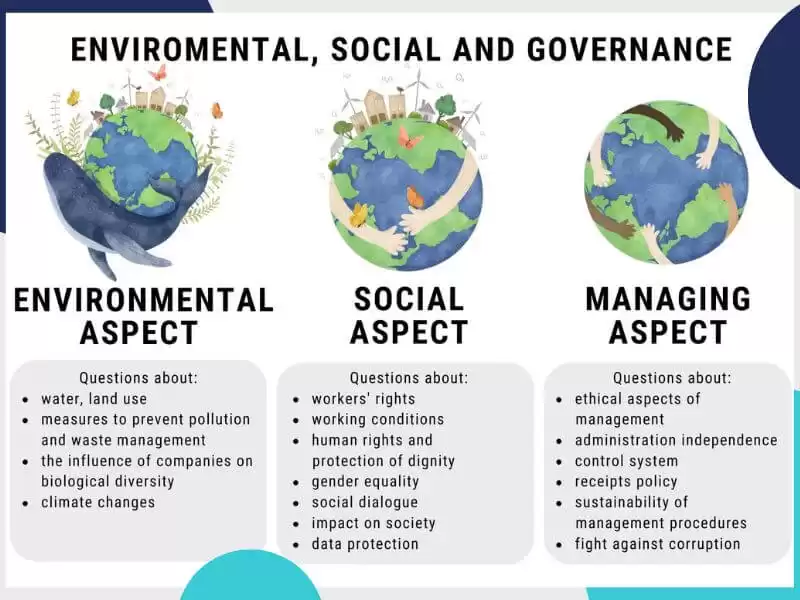

ESG stands for "Environmental, Social and Governance". It indicates three key factors that should be taken into account when measuring sustainability, ethics and socially responsible operations of a particular company or investment.

Examples of this kind of business include analysing how a company deals with climate change, how it treats its employees, how it treats its customers and suppliers, what its corporate culture is like, the quality of management, and the like.

Environmental, Social and Governance - from PR trick to legal obligation

Until recently, ESG was, to some extent, the subject of PR and conveniently placed stories that some companies had almost planted the Gardens of Eden. However, in reality, their impact on the environment and society was quite the opposite, and there's a lot to be said about the treatment of employees.

But as James Hatfield said, "So be it - Settle the score" there has been a significant change in the treatment of this information. Namely, the coordination of the Accounting Act, the Audit Act and the Capital Market Act, which should enter into force in 2024, is underway.

ESG reports should become formalized and suitable for submission to EU registers. Compared to the previous Directive on non-financial reporting, they must have a significantly more extensive scope of taxpayers.

Namely, for the next year, large entrepreneurs who are entities of public interest and who, on the balance sheet date, exceed the criterion of an average number of 500 employees during the previous business year are obliged to publish a non-financial report.

By amending the regulations, those liable to compile and publish non-financial reports will, from 2025, become large companies with more than 250 employees and all companies listed on regulated markets (except micro companies).

Environmental, Social and Governance - a financial trigger for sustainability

The new directive and uniform sustainability reporting standards will cover more than 49,000 companies across Europe, compared to the current 11,600, with the expectation of a much wider range of sustainability data regarding business models, strategy and value chain.

Ok, so what does this mean for users?

A lot of things, and primarily lower financing costs.

In particular, only those applicants who have completed and submitted ESG reports proving that they adhere to sustainable and socially responsible business will be able to enter the various loan interest subsidy programs supported by development banks, agencies and counties.

Domestic banks have already started in this direction, so they either have an ESG Questionnaire implemented or are on the way, and that document is a series of self-assessment questions for companies to which they present their business practices related to applying Environmental, Social and Governance principles.

But don't worry, in Croatia, these questionnaires - as stated in the example of the EU - are compulsorily filled out by large business entities that, on the balance sheet date, exceed the criterion of an average number of 500 employees during the financial year.

All others fill in this in one case: if they will finance the investment through the commercial bank and the development bank HBOR and through one of the programs from the National Recovery and Resilience Plan, which requires an interest subsidy.

A self-assessment questionnaire guided by the DNSH (Do Not Significant Harm) guidelines, or as it is officially called in Croatian, Primjena načela nenanošenja bitne štete (there is no abbreviation because PNNBŠ doesn't sound like much).

An example of such financing is, for example, the installation of a photovoltaic power plant or, colloquially speaking, a solar system on a commercial building.

There, not only the boxes or squares marked X are filled in, but the nature of the investment and specific figures related to emissions savings, new employment and the like are also descriptively expressed.

Nautical charter and ESG - rules of the game as your trump card towards sustainability

Ultimately, what can the nautical charter sector expect from ESG other than a bit more adjustment work?

In fact, it is a branch that, with its character and increasing orientation towards sailboats and catamarans, can take advantage of this principle because the trend of purchasing vessels is in the direction of sustainable ones and those that use less fossil fuels.

If the investment also includes new employment and savings on existing costs (mainly) of energy sources, you can be satisfied because you are thinking carefully in the interest of developing your business. And this will be expressed through a lower cost of financing.

At the end of the whole story, does a well-filled ESG document with pronounced savings mean a bigger possibility of loan or leasing approval?

No, not at all, and that's because of one single thing - the investment needs to make sense.

That is, the project should:

- generate a positive cash flow, i.e. achieve higher receipts than expenses,

- predict savings and ways to achieve them,

- prove that a sufficient amount of insurance covers the risk of investment failure.

If the conditions are not met and if this is not stated and proven in the accompanying investment study or business plan - nothing from the approval of the investment, even if they are Bill Gates aunt's brother or brother-in-law.

It is necessary to prove that the money will come to the house and not from it.

All the better if the common sense principles of sustainable business are respected and based on them, a loan is realized with an interest rate of 2.50% and a grace period of one year.

Fortunately, you have someone on your side who knows the subject and is available for all questions, and that is your čarter.hr.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox