Can you even ask for financing – from a bank, a fund, or the state – if you don’t believe in the business you’re running? In his new article for čarter.hr, Ivica Žuro addresses this somewhat uncomfortable but crucial question. But he’s not talking about procedures and required paperwork – he’s talking about trust. Trust in your business – which you either have or don’t…

Whether the year is good or bad – one must sail and do business.

And an unavoidable part of business is securing financial resources even for basic daily operations, let alone investing in business capacities. And also following the financing advice that should be respected if we want to live long on Earth and live well on it.

Everyone talks about the big ones, but it’s the small ones who carry the load.

Ideally, every company would have enough accumulation both for working capital and for making it through until it’s time to expand.

But since we don’t live in a perfect world, there are very few such companies, and that’s when the need for external sources arises.

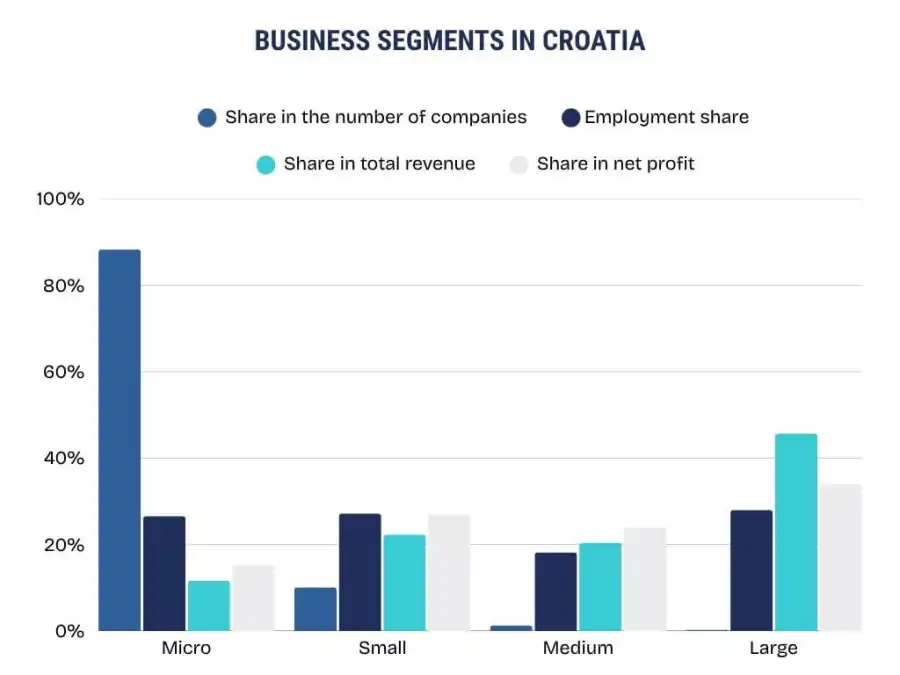

Micro, small and medium-sized enterprises operating here are the backbone of the national economy, accounting for 97.3% of all business entities, while employing 72% of the total workforce. They also account for 54.3% of total revenues and 66% of total profit.

Let’s put aside the fact that even 35 percent of companies, trades, and organizations in Croatia don’t have a single employee. Someone is clearly making money off them anyway. ;)

Large companies dominate in terms of total revenues and net profits on the Croatian market, and as local versions of too big to fall foreign companies, they are something like the cherished children of the domestic financial sector. Financing is available to them in larger amounts, options for going public are also on the table, whether through stock offerings or bond placements, and one can even discuss collateral terms in financing deals that are far less strict than for smaller firms. Every now and then, you also hear of a fund investing in a particular business organization.

Even medium-sized enterprises are highly desirable brides – after all, they make up only 1.3% of all companies, yet they account for 20.4% of consolidated revenues and 24% of net profits.

The financial sector – meaning domestic banks, since the capital market for such entities is not developed here – devotes significant attention to small and micro businesses through the most commonly used credit products.

As much as these products may be standardized, on the other hand, every business financing case is its own story because there are no unified balance sheets, profit and loss accounts, or collateral.

External financing – not because you want to, but because you have to

We will list the most common purposes for using external financing by small and medium-sized enterprises in Croatia. These are, in order:

- working capital financing – covering the ongoing operating costs such as purchasing raw materials, salaries, and other operational expenses.

- investment projects – investments in new equipment, machinery, production halls, and other capital investments that increase production capacity and efficiency.

- business expansion and development – financing entry into new markets, development of new products or services, and modernization of business processes.

- export financing – loans and incentives to support export activities and entry into international markets.

- leasing and factoring (accounts receivable purchasing) – as a form of asset financing and cash flow management.

- use of EU funds and state subsidies – for co-financing projects and development initiatives, typically combined with standard bank financing.

The main sources of external financing are bank loans (short-term, long-term, investment), leasing, factoring, subsidized loans through state and EU programs, and to a lesser extent, venture capital and business angels.

What each company can use depends on its size and age in the market.

What (and when) you’re allowed to ask for – depending on your stage

If it’s a business idea or a company that hasn’t been founded yet, there are two options:

- funds for (self-)employment if the activity is eligible, the founder is currently unemployed, previously closed a business more than 24 months ago, and has no outstanding tax or contribution debts. As the rap group Bad Copy would say: I have to be good.

- if they have an idea in the category of the next Facebook or something similar that would instantly affect millions of users – it makes sense to approach private equity funds.

Furthermore, if the company is established and has up to 1 year of operations, it is possible to apply to occasional calls from the municipality, city, or county. These often favor traditional crafts, trades, and similar activities.

If the company hasn’t yet completed 2 full business years, or it has 2 years but the last one was weaker, the option available is bank financing with a creditworthy co-debtor and other collateral provided by the owner. The rule here is: any private collateral provided by the owner – even if it’s a limited liability company – automatically raises the credibility of the entire application.

When someone (finally) offers you more than just a loan

The logical premise here is: if the owner themselves isn’t willing to offer anything extra to show they believe in their business – the bank won’t be willing either.

If the business has at least 2 years and positive indicators, that’s when a whole range of possibilities opens up.

If it’s a matter of applying to a call for non-refundable grants, it is possible to finance investments at significantly lower costs. In that case, the most logical solution is financing with interest rate subsidies, external guarantees and/or potential principal reduction as a grant.

A concrete example from the author’s own business practice is the installation of photovoltaic power plants on a number of business facilities, which were often financed with a grace period of up to 1 year and an interest rate lower than 1.00 percent.

If there are no open calls, the costs are somewhat higher, but external financing is still entirely attainable.

The only difference is that in such cases the interest rates on loans approved by the banking sector will be slightly higher than in the case of existing calls for grants or subsidies. And keep in mind that some form of personal guarantee will be required, such as co-signing the company’s promissory note or similar. If the owner isn’t ready to show they believe in their business – the bank won’t be either.

For example, no matter how much the business grows or the indicators look good, if you’re not willing to provide a personal guarantee but are asking HAMAG for a credit guarantee for some financing – you won’t get it, because that state agency for promoting entrepreneurship operates by that logic.

In the end, if you’ve already spent two or more years building your business to the point that work is flowing in and you’re expanding, it’s no surprise if a potential co-investor shows up in the form of another organization or maybe even a VC fund.

In fact, that’s what I truly wish for you.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox